The Ultimate Guide to Online Forex Trading

Online Forex trading has revolutionized the financial landscape, providing individuals and institutions with the ability to trade currencies from the comfort of their homes. Whether you’re a novice or an experienced trader, understanding the intricacies of Forex trading is essential. In this guide, we will delve into the basics of Forex trading, the advantages it offers, various strategies to enhance your trading experience, and how to choose a reliable platform. For more information, check out forex trading online exbroker-turkiye.com.

Understanding Forex Trading

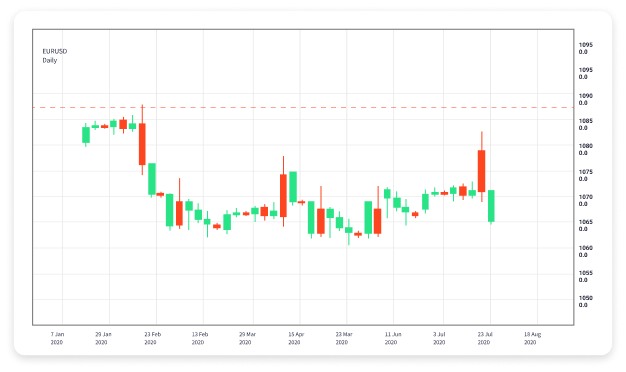

The foreign exchange market, commonly referred to as Forex or FX, is the largest financial market in the world. It operates 24 hours a day, five days a week, allowing traders to buy, sell, and exchange currencies. Currency trading involves a variety of pairs, such as EUR/USD or GBP/JPY, where one currency is traded against another. The objective is to profit from the fluctuations in currency exchange rates.

Benefits of Online Forex Trading

There are numerous advantages to trading Forex online, which include:

- Accessibility: Online Forex trading allows individuals to enter the market easily. Traders do not need large capital to start, and various trading platforms enable access from anywhere with an internet connection.

- Liquidity: The Forex market is highly liquid, meaning trades can be executed quickly and at transparent prices, providing opportunities for traders at all levels.

- Leverage: Forex brokers typically offer leverage, allowing traders to control larger positions with a smaller amount of capital. This can amplify profits but also comes with increased risk.

- Variety of Trading Options: Forex trading offers numerous currency pairs and trading instruments, including CFDs and commodities, providing diverse opportunities for traders.

Getting Started with Forex Trading

To embark on your Forex trading journey, follow these essential steps:

- Choose a Reliable Broker: Selecting the right broker is crucial for your trading success. Look for brokers regulated by credible financial authorities and those offering user-friendly platforms.

- Create a Trading Account: Once you’ve chosen a broker, open a trading account. Most brokers offer demo accounts, allowing you to practice trading without risking real money.

- Learn the Basics: Familiarize yourself with the basic concepts of Forex trading, including pips, spreads, margin, and leverage. Understanding these terms will aid in making informed trading decisions.

- Develop a Trading Strategy: A well-defined trading strategy tailored to your financial goals and risk tolerance is essential. This may include technical analysis, fundamental analysis, or a combination of both.

- Start Trading: Begin trading with small amounts and gradually increase your investment as you gain experience and confidence. Remember to stay disciplined and manage your emotions while trading.

Popular Trading Strategies

Successful Forex trading often relies on effective strategies. Here are a few popular approaches:

- Day Trading: This strategy involves making multiple trades within a single day to capitalize on short-term market movements. Day traders often close their positions before the market closes.

- Swing Trading: Swing traders aim to capture short to medium-term price movements by holding positions for several days or weeks. This strategy requires a good understanding of technical analysis.

- Scalping: This is a high-frequency trading strategy that involves making numerous trades throughout the day, taking advantage of small price fluctuations. Scalpers require quick decision-making skills and disciplined execution.

- Trend Following: This strategy focuses on identifying and following the overall market trend. Traders buy when prices are rising and sell when they are falling, relying on various indicators to confirm trends.

Risk Management in Forex Trading

Risk management is a crucial aspect of Forex trading success. Here are some effective risk management strategies:

- Set Stop-Loss Orders: A stop-loss order automatically closes a trade when the market reaches a specified price, limiting potential losses.

- Use Proper Position Sizing: Determine the appropriate amount of capital to risk on each trade based on your overall account size and risk tolerance.

- Diversify Your Trades: Avoid putting all your capital into a single trade. Diversifying among different currency pairs can help mitigate risks.

- Limit Leverage Usage: While leverage can increase profits, it also amplifies losses. Use leverage wisely and understand its implications.

Conclusion

Online Forex trading offers exciting opportunities for traders worldwide. By understanding the market dynamics, developing sound strategies, and effectively managing risks, you can enhance your chances of success. Remember, continual learning and staying informed about market trends are key to becoming a proficient Forex trader. As you navigate this dynamic environment, consider leveraging resources such as exbroker-turkiye.com for further insights and support.

style=”display:none;”>